Technical analysis tool with charts for crypto trading on Binance, Bybit and OKX

When it can be useful

It can be used as an additional tool for determining the entry point into a trade when a level (or trend line) is broken, a rebound from a level, or when working with large limit orders.

Login and identification in the system

To log in the app, you need to get a link in the telegram bot chat @WatchlistTopBot. When you first log in, a user account is created.

For this you need:

- open bot chat @WatchlistTopBot,

- press the "Start" button - this is done once at the first login,

- in the chat menu, select and click the "Get auth link" button,

- copy the received link and follow it in the browser.

Important! If the link is received from different telegram accounts, then in the application it will also be different accounts. Therefore, to work in the future, you need to select and remember from which telegram were the authorization and subscription.

How does it work

For work, the public API of the cryptocurrency exchanges is used. Coins from the spot and/or futures market can be selected for tracking.

All user settings (drawn custom figures, set sound notifications about price levels, currently selected timeframe, chart display mode, currently selected coin) are saved on the server and can be accessed from any device after authorization.

App modes

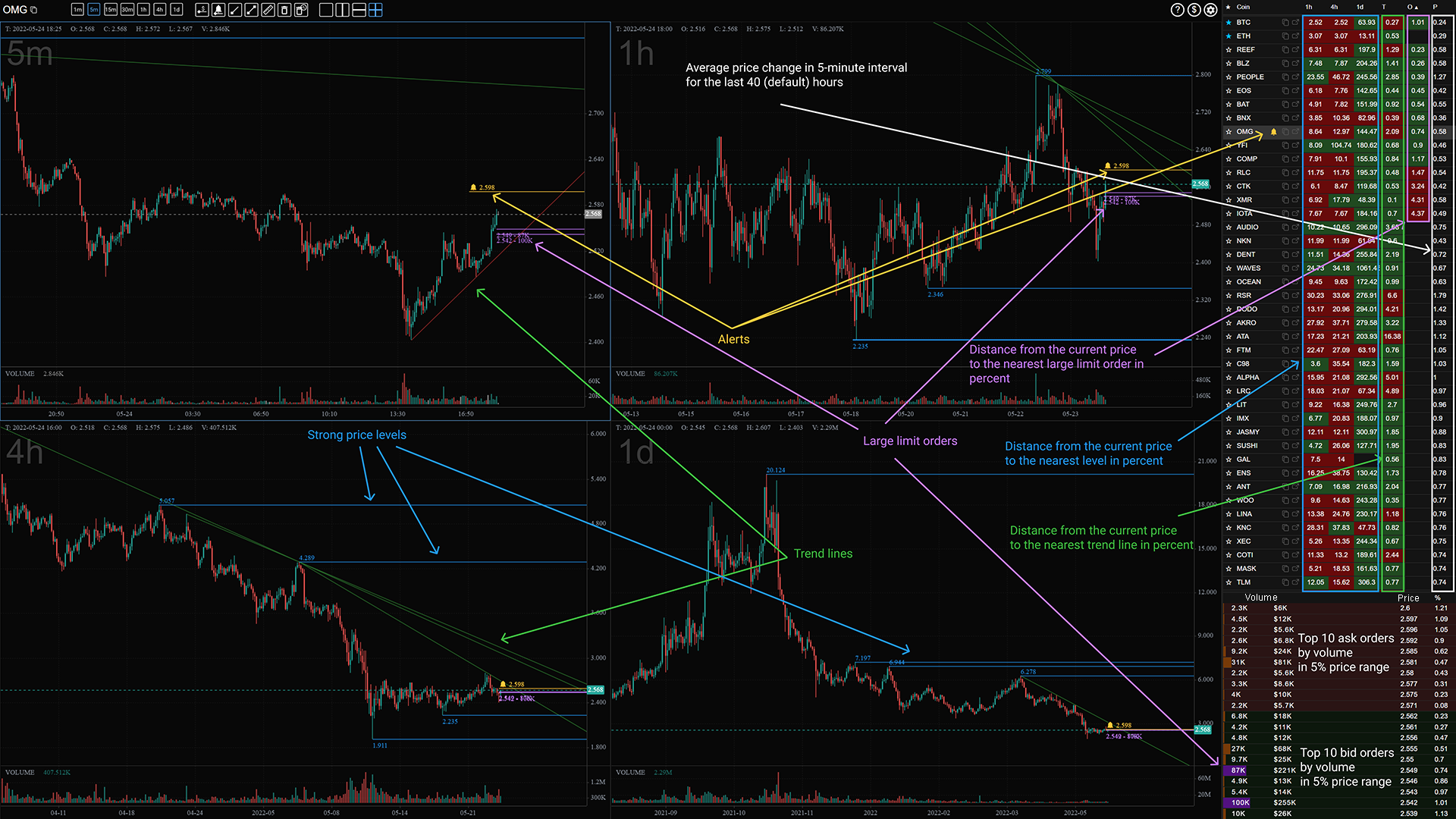

List mode

In the list mode, charts, a coin list and TOP orders by volume are displayed in one window.

Grid mode

In grid mode, only charts (one or more coins) are displayed in one window. This mode can be used to monitor a selected small list of coins for the current trading session.

Single coin mode

A window in single coin mode opens when you click on a link from the list of coins. Each coin has its own individual address. In this mode, it is possible to display charts of only one coin in one window.

Interface

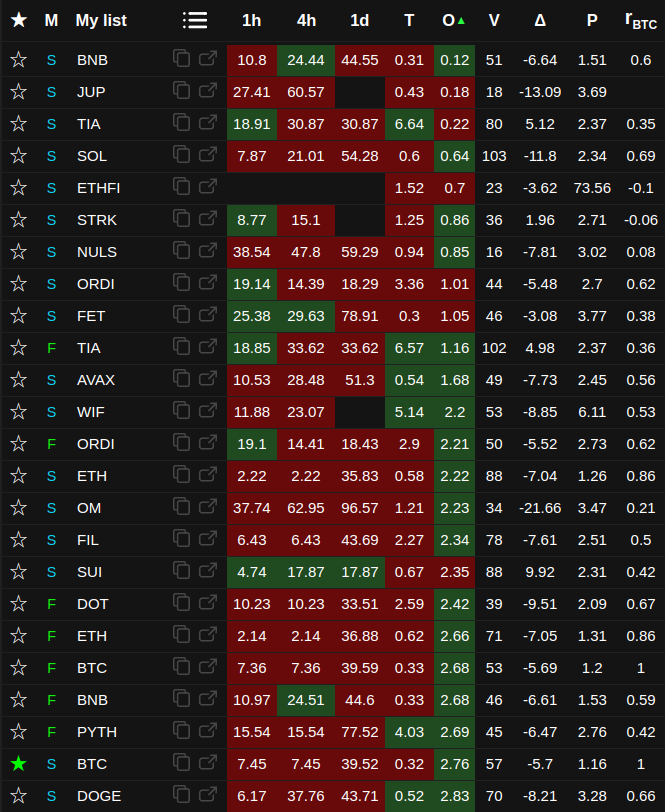

Last 24 hours change screener

The 24h change screener is a table that is enabled when you click on the button next to the list name (three horizontal bars) or the plus button if no list has been created. Screener is designed to enable and disable coins in the list based on market data - price and volume dynamics by instruments, coin quotes, market (spot or futures).

The first time you turn on the app, all coins are disabled. It is necessary to select the necessary ones using filters, mark checkbox them and click the save button at the bottom of the table.

Important! Filters do not enable or disable coins. Filters only limit the selection of coins shown in the table. Only checkboxes are used to enable/disable.

The state of enabled/disabled coins is saved when working with filters.

At the bottom of the table, the current status is shown in the fields Total, Filtered, Total enabled. The values in these fields can be used to check if the coins have been included correctly.

For example, to disable all coins, you need to disable all filters (enabled filters are highlighted with a brighter color). If all filters are disabled, then the number of coins Total will be equal to the number of Filtered. If it's not, it means that some filter remained on.

As a result, after saving, the list will contain the number of coins specified in the Total enabled field.

List of coins

A table with a list of all coins in the right area of the window.

☆ Favorites - coins of interest can be added to separate lists (up to six)

M (market) - spot or futures market, if all coins are from the same market, then the column is not shown.

🔔 - notifications. The column is displayed if at least one notification is set. The list shows the percentage distance from the current price to the nearest price for which the notification is set. Notifications are automatically duplicated in the telegram bot chat. You don't need to make any special settings.

1h, 4h, 1d - percentage distance from the current price to the nearest level on the corresponding timeframe. Also can be enabled in the settings 15m, 30m timeframes. Sorting in ascending order is possible.

T (trend) - distance from the current price to the nearest trend line in percent. Sorting in ascending order is possible. By default, trends are tracked on all analyzed intervals. In the settings it is possible to disable / enable certain intervals. If all intervals are off, then the column is not shown in the list. If more than one interval is enabled, then on the first click it sorts by all timeframes, on the second and on the next clicks, the sorting is switched by the enabled timeframes in order (the timeframe is indicated next to "T").

O (order) - distance from the current price to the nearest large limit order in percent. Sorting in ascending order is possible. To determine whether the order is large, it is compared with a threshold volume specially calculated for each coin.

P24 - price change over the last 24 hours as a percentage. Sorting in ascending and descending order is possible.

V24 - volume in the quote coin over the last 24 hours. Sorting in ascending and descending order is possible.

NATR - normalized average true range for the last candle (it is possible to enable the NATR indicator for the entire chart). Sorting in ascending and descending order is possible.

V (volume) - the difference between the volume of the last candle and the average volume as a

percentage. Calculated as:

(volume of the last candle - average volume) / average volume * 100%

Sorting in ascending and descending order is possible. The average volume parameters are determined in the settings.

It is possible to set an alert if the volume exceeds the average value; to do this, you need to click on the

selected coin in the volume column.

Notifications are delivered to the browser only.

Δ (delta) - price change in percent for the last candle in the interval selected in the

settings.

Calculated as ((close - open) / open) * 100%

The indicator can be used to track price spikes on small timeframes.

If no interval is selected in the settings, the column is not shown in the list.

It is possible to set an alert if the price has fallen or increased by a percentage greater than the specified

value; to do this, you need to click on the selected coin in the price change column.

Notifications are delivered to the browser only.

P (price) - average price change in percent for the selected timeframe for the specified period in

settings (the period is specified by the number of candles of the selected timeframe).

For this indicator, relative change for each timeframe is calculated as (high - low) / low and then the average

value is calculated as the sum of all changes divided by the number of candles in the period.

If no interval is selected in the settings, the column is not shown in the list.

The indicator can be used to assess the volatility of the instrument.

rBTC - correlation of the coin price with the Bitcoin price for the timeframe and period

selected in the settings (the period is defined by the number of candles).

If no timeframe is selected in the settings, the column is not shown in the list.

TOP orders

Table below the list of coins. The table displays the 10 largest orders on each side (ASK, BID) from range +-5% of the price sorted by price. If there is a smaller number in this range, then all are displayed.

At the left edge of the table, a horizontal chart of order volumes is displayed, each column of which corresponds to the volume of the order at this price. Large volumes are highlighted in yellow and purple. Purple color highlights orders whose volume is greater than the threshold volume (also drawn as a purple price level on the chart).

The threshold volume can be calculated automatically based on the parameters specified in the settings, or it can be set its own value for each coin.

Auto calculation of threshold volume

If a fixed value is not set, then the threshold volume is calculated as the product of the average volume and multiplier specified in the settings. An example of the average volume values can be seen by setting the multiplier in the settings equal to 1.

Average volume is the average value of the volumes of all orders from the TOP, the volume of which is greater than the median value excluding extreme values.

Charts

It is possible to display one or more charts of one or more coins in one window.

The maximum number of charts in one window is determined by the screen resolution.

Support and resistance levels and trends are drawn automatically. Levels and trends crossed by the price change color to gray. Crossed levels and trends (gray) persist between sessions, by first click on button in the interface are deleted only for the current coin, on the second click they are deleted for all coins.

Drawing of several types of figures is available: segment, ray, price level, Fibonacci levels, price channels.

To delete a shape click on it by the right mouse button. To delete all custom shapes at the same time - click the Trash button in the interface. On touchscreen devices, to delete, double-tap the corresponding shape button (it turns red in delete mode), and then tap the shape you want to delete.

On the daily timeframe, only daily levels are displayed, on the four-hour - daily and four-hour, on the hour and less, all levels are displayed.

The levels of higher timeframes on the chart of lower timeframes are highlighted with a line thickness, for example, on an hourly chart, hourly levels are lines of 1 pixel thickness, four-hour levels are lines of 2 pixels, daily levels are 3 pixels.

Large limit orders are drawn with purple levels. The beginning of the order line is at the point at which the order was placed in the order book. If the order was placed before the app was launched, then the line starts from the moment the tool is turned on.

Hotkeys

F1 - help

Esc - cancel drawing / close dialog box

← → - switching the timeframe of the selected chart

↑ ↓ - switch between coins in the list

Tab - switching between charts if more than one chart display mode is selected

+/- increase/decrease the chart scale

Shift + click on chart - measure tool

Shift - cancel drawing mode, remove measure tool

F6 - first click - deleting crossed levels and trends of the current coin, second click - same for all coins.

F7 - drawing price alerts.

F8 - drawing price levels.

Shift + F9 - remove all price alerts.

Letters/numbers - ticker search

Right-click in the list area - enable/disable auto-sorting.

Mouse pointer over the list - if autosorting is enabled, while the mouse pointer is over the list, autosorting is disabled.

Ctrl + c - copy the ticker of the current coin.

Ctrl + o - opens the current coin in a new window in single coin mode.

Ctrl + Delete - deletes the current coin from the list.

Ctrl + x - show/hide the list in list mode.